Allianz Travel Insurance: What You Need to Know – NerdWallet

Allianz Travel Insurance is provided by Allianz Global Assistance, an insurer that operates in 35 countries and serves 40 million customers in the U.S. The company offers several different types of travel insurance plans depending on your needs.

Travel insurance will help protect you if unexpected events affect your vacation. Whether you’re looking for a comprehensive plan or emergency medical coverage only to supplement the travel insurance you have from your credit cards, Allianz Global Assistance offers plenty of options to choose from. We’ll evaluate travel insurance plans provided by Allianz Global Assistance to help you decide if they are right for you.

What plans does Allianz Travel Insurance offer?

Allianz offers several different travel insurance options depending on whether you’re looking for a single or annual/multi-trip plan.

Allianz Travel Insurance: Single Trip Plans

Single trip plans are designed for individuals who are leaving their home, visiting another destination (or destinations) and returning home. Allianz Global Assistance has five travel insurance plans for single trips, including a plan that’s mainly focused on emergency medical coverage.

Coverage

OneTrip Cancellation Plus

OneTrip Basic

OneTrip Prime

OneTrip Premier

OneTrip Emergency Medical

Trip Cancellation

$5,000

$10,000

$100,000

$100,000

Trip Interruption

$5,000

$10,000

$150,000

$150,000

Emergency Medical

$10,000

$25,000

$50,000

$50,000

Emergency Medical Transportation

$50,000

$500,000

$1,000,000

$250,000

Baggage Loss/Damage

$500

$1,000

$2,000

$2,000

Baggage Delay

$200

$300

$600

$750

Travel Delay

$150

$300

$800

$1,600

$1,000

Daily limit

$150

$150

$200

$200

$200

Travel Accident

$10,000

SmartBenefits℠

$100

$100

Change Fee Coverage

$500

$500

Loyalty Program Redeposit Fee Coverage

$500

$500

24-Hr. Hotline Assistance

✓

✓

✓

✓

✓

Concierge

✓

✓

✓

Rental Car Damage Protector

optional

optional

Required to Work

optional

Pre-Existing Medical Condition

available

available

available

available

The OneTrip Cancellation Plus plan is geared toward domestic travelers who are looking for trip cancellation, interruption and delay coverage but don’t need post-departure benefits like emergency medical or baggage loss. This plan is Allianz’s most affordable option.

OneTrip Basic, Prime and Premier are three comprehensive travel insurance plans.

-

OneTrip Basic is the most economical plan and offers trip cancellation, interruption and delay benefits along with emergency medical and baggage loss.

-

OneTrip Prime provides all the benefits of the Basic plan but with higher limits, a few extra coverage areas and complimentary coverage for children 17 and under when traveling with a parent or grandparent.

-

OneTrip Premier offers the most coverage, doubling almost every post-departure limit of the Prime plan with more covered cancellation reasons.

If you don’t need pre-departure trip cancellation and interruption protections or you already have coverage through a premium travel credit card, the standalone OneTrip Emergency Medical plan may be a good choice. The plan mainly provides emergency medical protections along with some baggage loss/delay benefits.

Allianz single trip plan cost

Now that you know about the plans, let’s consider the cost of an Allianz travel insurance policy for a one-week, $1,500 vacation to Croatia in August 2020 taken by a 30-year-old from Texas.

The OneTrip Premier is the most expensive plan and provides the highest level of protection, especially for emergency medical events. However, if you’re OK with lower limits on emergency medical, a OneTrip Prime or Basic plan could be a more appropriate choice. These costs represent a range of 3.4%-7.5% of the total cost of the trip, which is in line with typical costs, according to the U.S. Travel Insurance Association (4%-8%).

» Learn more: The majority of Americans plan to travel in 2022

Allianz Travel Insurance: Annual/Multi-trip Plans

These plans are designed for those who like to take a lot of little trips throughout the year as well as for business travelers. Allianz Global Assistance offers four different annual/multi-trip plans.

Coverage

AllTrips Basic

AllTrips Prime

AllTrips Executive

AllTrips Premier

Trip Cancellation

$3,000 *

$5,000 / $7,500 / $10,000 *

$2,000 / $5,000 / $10,000 / $15,000 *

Trip Interruption

$3,000 *

$5,000 / $7,500 / $10,000 *

$2,000 / $5,000 / $10,000 / $15,000 *

Emergency Medical

$20,000

$20,000

$50,000

$50,000

Emergency Medical Transportation

$100,000

$100,000

$250,000

$500,000

Baggage Loss/Damage

$1,000

$1,000

$1,000

$2,000

Baggage Delay

$200

$200

$1,000

$2,000

Travel Delay

$600

$600

$1,600

$1,500

Daily Limit

$200

$200

$200

$300

Travel Accident

$25,000

$25,000

$50,000

$50,000

Business Equipment Coverage

$1,000

Business Equipment Rental Coverage

$1,000

Change Fee Coverage

$500

Loyalty Program Redeposit Fee Coverage

$500

24-Hr. Hotline Assistance

✓

✓

✓

✓

Concierge

✓

✓

✓

✓

Rental Car Damage & Theft

$45,000

$45,000

$45,000

$45,000

Pre-Existing Medical Condition

available

available

available

AllTrips Basic is suitable for those who would like emergency medical coverage while abroad but don’t need trip cancellation and interruption benefits. The AllTrips Prime, Executive and Premier plans provide an entire year of comprehensive travel insurance benefits.

The Executive and Premier plans offer various levels of trip cancellation and interruption benefits. The Executive plan is specifically designed for business travelers since it offers protection for business equipment.

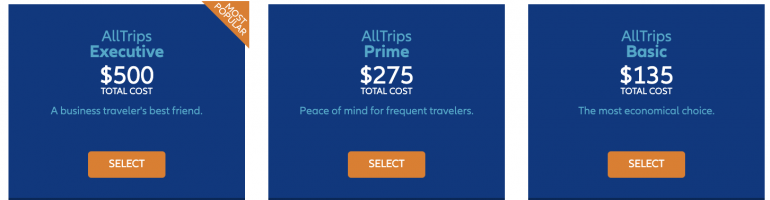

Allianz annual/multi-trip plans cost

Let’s look at an example of an annual Allianz travel insurance plan that starts in July 2020 for a 50-year-old from Illinois.

Coverage under these plans is offered for trips up to 45 days in length.

The AllTrips Executive plan costs significantly more than the other plans; this is mainly due to higher trip cancellation coverage, emergency medical and business equipment protections. The Executive coverage amount for trip cancellation can be increased beyond what is quoted here, driving that plan’s price up to as much as $785.

If you’re not concerned with pre-trip cancellation benefits and don’t need the increased level of medical coverage, the Basic plan is the most affordable option.

For trips longer than 45 days, the AllTrips Premier plan might be a better choice as it offers coverage for up to 90 days. Using the same search parameters but with 90 days of coverage per trip, the cost of the annual plan is $475.

» Learn more: How to find the best travel insurance

Which Allianz travel insurance plan is best for me?

Choosing the right plan for your trip involves understanding what type of coverage you will want while you’ll be abroad.

-

If you have a premium travel card (e.g., the Chase Sapphire Reserve®) that already provides you with a sufficient level of trip cancellation coverage, getting the OneTrip Medical plan might be enough.

-

If the coverage provided by your card isn’t adequate, you don’t have credit card coverage or you didn’t pay for your trip with that credit card, then you might be better off with a comprehensive plan like the OneTrip Basic, Prime or Premier.

-

If you’ll be going on multiple and longer trips, the AllTrips Premier plan might be best as it provides insurance benefits for trips up to 90 days in length.

-

The remaining three annual AllTrips plans cover multiple trips, up to 45 days.

» Learn more: Your guide to Chase Sapphire Reserve travel insurance

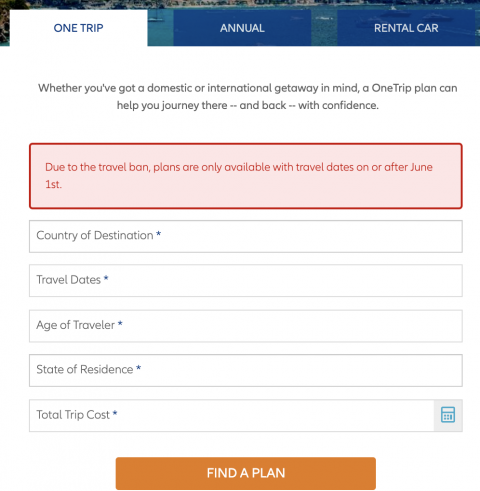

How to choose an Allianz plan online

Head over to AllianzTravelInsurance.com and choose “Find a Plan” from the menu on the top.

You will be able to view all plans or see plans categorized by single trip, annual/multi-trip and a rental car add-on option. Once you’ve decided on the plan you want, choose the “Get a Quote” option.

You will be required to input the relevant trip details before you can see which plans are available to you in your state.

What isn’t covered

Travel insurance plans have a lot of exclusions that you need to pay attention to so you know exactly what type of coverage you’re getting. Here are some general exclusions you can expect:

High-risk activities: Skydiving, bungee jumping, heli-skiing, and other types of high-risk sporting activities that the insurer deems unsafe.

Intentional acts: Losses sustained from intoxication, drug use, self-harm and criminal activity.

Specifically designated events: Epidemics, natural disasters and war are specifically mentioned in the policy as exclusions.

It’s important to note that exclusions may vary based on the policy and where you live, so it’s always best to review the fine print to ensure you’re clear about what is and isn’t covered.

Frequently asked questions

Is Allianz travel insurance any good?

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different customer needs.

What is covered under Allianz travel insurance?

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

Does Allianz travel insurance cover cancel for any reason?

No, Allianz does not offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel is not.

How does Allianz trip insurance work?

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

Is Allianz travel insurance any good?

Allianz has been offering insurance for more than 25 years. The company is well established and offers numerous single and annual travel insurance policies to fit many different customer needs.

What is covered under Allianz travel insurance?

Allianz travel insurance plans offer a wide array of benefits including (but not limited to): coronavirus-related coverage, trip cancellation, interruption, emergency medical coverage and transportation, baggage loss/damage, baggage delay, travel delay, change fee coverage, loyalty program redeposit fees, 24-hour assistance and many more benefits. Each plan is different, so you’ll want to look at the specific plans you’re considering to know exactly which benefits you’ll receive.

Does Allianz travel insurance cover cancel for any reason?

No, Allianz does not offer the Cancel For Any Reason optional upgrade. Review the policy details of the Allianz plan you’re considering to ensure you’re comfortable with the list of covered reasons. For example, the loss of a job can be considered a covered reason, but wanting to cancel a trip because you’re afraid to travel is not.

How does Allianz trip insurance work?

Most often, you will need to file a claim with the insurer after you’ve incurred costs. If the claim is approved, you will receive a reimbursement. In other instances (e.g., covered baggage delay), the insurer will pay you a fixed amount per day and you won’t need to submit receipts.

The bottom line

Before going on a trip, it’s a good idea to review different travel insurance options to make sure you’re protected in case of an emergency while abroad. No matter what type of traveler you are, Allianz Global Assistance offers various travel insurance plans to choose from.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2022, including those best for: