Don’t Be Misled By Colonial Penn Life Insurance For Seniors ($9.95)

You’re flipping channels, trying to find something to watch, when an old familiar face comes on the TV.

You reminisce on the days you watched Jeopardy as Alex Trebek’s familiar voice fills your home.

You continue to watch, intrigued, as to what he’s offering.

“For just $9.95 a month…

Less than 35 cents a day…

Benefit never ends…

Premiums won’t go up…”

Maybe he’s selling what I need, you think.

Just what is it that Alex Trebek is selling?

Colonial Penn’s $9.95 a month final expense life insurance.

Well, I could use some life insurance, you think. And for just $9.95 a month?

“I can make that work, Alex,” you tell the TV as you turn up the volume and pay a bit closer attention.

What your old friend isn’t telling you is what’s in the fine print. Colonial Penn offers life insurance sold in a way that most don’t offer – per unit.

And while Colonial Penn wants you to think it is a good deal, it’s a lot further from the truth than you think.

AND MORE EXPENSIVE!

Just what is Alex trying to sell you and why don’t you want it?

You have lived long enough to know that if it SOUNDS TOO GOOD TO BE TRUE it probably is.

Find out why the Colonial Penn life insurance for seniors $9.95 a unit policy is not your best option and maybe one of your worst options to prepare for when the good Lord calls you home.

The Problem With The Colonial Penn $9.95 Life Insurance Unit

When you buy life insurance from a reputable life insurance company, you purchase a death benefit, not a life insurance unit. For example, let’s say you want to pay for funeral expenses and final medical bills, so you want coverage for $25,000.

With a life insurance company, you can buy that amount of coverage. With Colonial Penn, you can only buy a unit.

Units are a bit strange because as you get older the amount of death benefit you are entitled to goes down while the price of the units stay the same.

Let’s say you’re a 68-year-old man living in Houston. You call Colonial Penn to get a quote for $15,000 in coverage and they tell you they can’t do that– you have to buy units.

They ask for your information to plug into their system to give you a quote:

· Name

· Date of birth

· Address

· Phone number

· Email address

For a 68 year-old-male, 1 unit at $9.95 a month qualifies you for a total of $792 in life insurance coverage.

Yes, $792 per $9.95 each month for one unit. Now, you wanted $15,000 in coverage, right? Unfortunately, the maximum number of units you can purchase through Colonial Penn is 12. This means the maximum a 68-year-old male can purchase is $9,504 in life insurance coverage with a monthly premium of $119.40.

Colonial Penn will be happy to get that coverage in place today without answering any health questions or taking a medical exam. Just complete the application, submit payment, and you think that you are fully covered by the amount you qualified for.

However, in addition to not getting as much coverage as you initially wanted, there are other reasons why these policies aren’t always the best choice; especially for seniors with average health.

Guaranteed Acceptance plans like these have a 2-year waiting period for death by natural causes. Meaning, if you die from an illness or pre-existing health condition during the first two years, you don’t receive your full benefit amount.

What Colonial Penn doesn’t tell you is most seniors will qualify for a plan with day-1 coverage, and with lower pricing from other companies.

Final Express Direct can usually find a policy that costs you less money per month, pays a larger death benefit AND you will be immediately covered in full from day 1! You won’t have to wait two years for your policy to start protecting your family.

What was Alex Trebek thinking?

Compare and buy

final expense

It Is Important To Understand Guaranteed Issue Colonial Penn Life Insurance

Life insurance coverage without any health or medical questions is called guaranteed issue life insurance because you’re guaranteed coverage no matter what.

Sounds great, right?

But of course there is a catch…

With guaranteed issue life insurance, your beneficiary doesn’t get the full death benefit if you die within the first two years of the policy.

Note: According to a Penn State University study, 99 percent of all term policies never pay out a claim. Contact us to insure your family receives your life insurance money.

If you’re in congestive heart failure, on oxygen, or terminally ill, it might be ok to gamble that you live the next two years.

But for the vast majority of red blooded God fearing hard working Americans, it’s probably not the best option.

If you die during the first two years of the policy you will only get what is called a graded death benefit, which means Colonial Penn will pay back the premiums you paid, plus interest. That’s it.

So while Alex is willing to sell you some cheap guaranteed issue life insurance, Colonial Life doesn’t want you to know what’s in that fine print.

Lucky for you, we’ve got a much better solution for you.

-

Immediate Approval Over the Phone Today!

-

Speak

to a

Live Agent

-

Just a Few Health Questions

Colonial Penn Life Insurance Reviews

At the end of the day everyone just wants an honest company that is going to do what they say for a fair price.

I think you will see in this Colonial Penn Life Insurance Reviews section that we try and answer these questions.

If you were to review the major things you want in a life insurance company you’d think:

- Ability to pay the claim

- Cost of life insurance

- Customer service

And probably in that order of important, too.

No one is doubting Colonial Penn’s ability to pay it’s claims, they have been around for a long time and are a financially sound company.

However, their cost of life insurance is quite a bit more than their competitors. They have just figured out a way to package it in $9.95 units that is sold to you by that handsome silver fox Alex Trebek.

Don’t be fooled, Colonial life insurance is much more expensive, give me a call and I can better explain. Dial 1-877-674-0236, and you get through right away to a live person on the other end.

Last, after reading countless Colonial Penn Life Insurance reviews, I can tell you that their customers service is not highly rated. In fact, it is probably the most complained about out of everything.

Do you really want to pay too much for life insurance and then have your family spend months or years fighting with that company to get their money you planned for them to have upon your passing?

Let Final Expense Direct help you find the least expensive final expense insurance with the best customer service for your family today.

Compare and buy

final expense

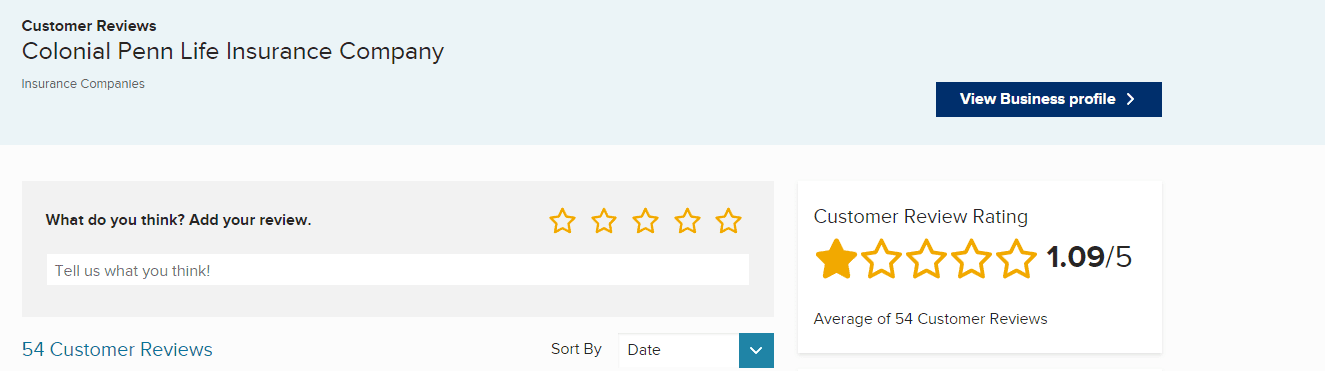

Colonial Penn Life Insurance BBB (Better Business Bureau) Reviews & Complaints

The Better Business Bureau is an independent agency that tracks interactions between US businesses and US customers, such as yourself.

It is a well respected organization that allow customers to use a third party to register their feelings about their past experiences.

For these reasons we at Final Expense Direct, highly value the company ratings from BBB and their customer reviews.

Colonial Penn Life Insurance Reviews at the BBB, Better Business Bureau, are pretty bad. They show a customer review average rating as of 6/19/2022, of 1.09 out of 5.0.

Customers complain regularly about the $9.95 per unit life insurance policies Colonial Life Insurance sells seniors.

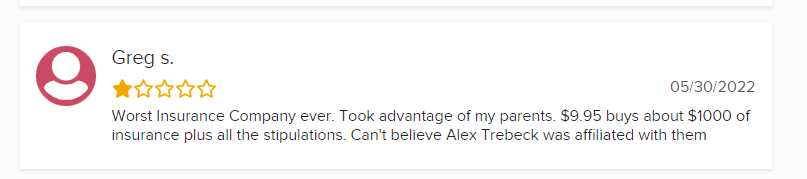

Greg S. on 5/30/2022, gave reviewed Colonial Penn 995 Plan as a 1 star, saying that they took advantage of his parents and was very disappointed Alex Trebeck was affiliated with them.

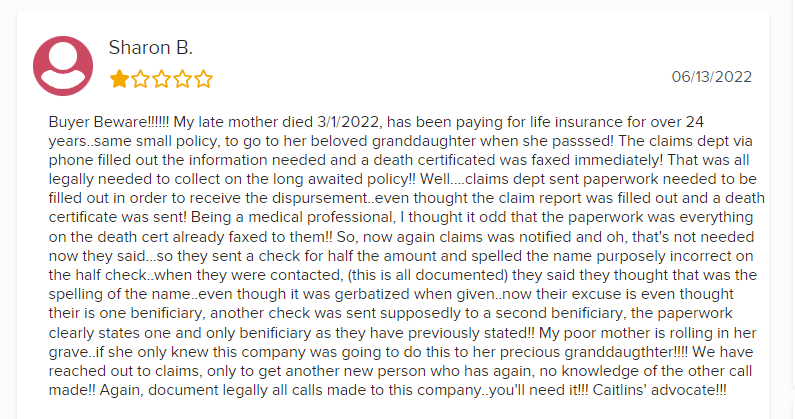

The complaints about Colonial Penn’s life insurance department customer service go on and on. Like Sharon B.’s review on 6/13/2022 where she details multiple calls to customer service to try and get the life insurance their mother paid on for 24 years.

One problem after another and none of the departments ever seem to know what the other one is doing. Sharon’s Colonial Penn Life Insurance review and complaint above is very similar to many of the others.

There definitely is a pattern here… buyer beware, as Sharon B. suggests, ‘buyer beware’ indeed.

But, don’t believe me, you can do your own research and look into Colonial Penn Life Insurance Reviews at the Better Business Bureau here.

A Better Life Insurance Solution

At Final Expense Direct, we work directly with a long list of life insurance carriers to offer you one product:

Final expense life insurance.

You get:

-

Locked in premiums for life

-

Benefits that never decrease

-

No medical exam required

-

Coverage from some of the best final expense companies

And the best part – the full death benefit is available from day 1! If you purchase a final expense life insurance policy through FED and you die the next day, your beneficiary gets the full death benefit, whether it’s $10,000 or $100,000.

Now, we do ask you a few health questions, which we know Colonial Penn doesn’t do. But the reason we ask those health questions is because it helps us find you the best coverage for the cheapest price.

We won’t be offering you $7,456 in coverage for $79.60 a month.

We think you’re worth more for far less cost each month.

While Colonial Penn mostly wants to deal with you through the mail, we’re available on the phone right now. You don’t have to jump through hoops when you call us either.

Just pick up the phone, dial 1-877-674-0236, and you get through right away to a live person on the other end.

At FED, we have over 35 years of experience working with people just like you, the backbone of America. You’ve worked hard your entire life, and we want you to keep as much money as possible while also getting as much life insurance as you can to protect your family when you’re gone.

A Must Read: Why You Should Reconsider Buying Funeral Insurance From A Funeral Home

After you answer a few health questions, we can help you pick the best life insurance plan available. We complete the application right over the phone and get you approved before you hang up.

Just one phone call to Final Expense Direct and you’ll hang up with a whole life insurance policy. You also get accidental death coverage, which means your beneficiary gets paid even more if you die in an accident – which is much more likely to happen if you aren’t terminally ill already.

At Final Expense Direct, we offer more than just life insurance, we offer peace of mind.

While watching Alex Trebek in the Colonial Penn commercials can bring back a bit of nostalgia, don’t fall for that silver foxes well intentioned words.

Instead, speak with a FED agent so we can help you find the best life insurance coverage for your family, and not what Alex Trebek got paid to advertise.

Why pay more when you don’t have to? Answer a few simple health questions to unlock a whole life insurance policy that works for you from the day you buy it.

No gimmicks. No fine print. Just affordable coverage that’s there when you need it most. To protect your family after you’re gone.

Get peace of mind with one phone call to Final Expense Direct today, dial 1-877-674-0236, and you get through right away to a live person on the other end.

![]()

Related:

The Lord Is Calling Me Home – What Happens If You Die With No Money And No Life Insurance?