Sproutt Life Insurance Review for 2022 | LendEDU

Key points:

- Sproutt is a life insurance marketplace that uses data and artificial intelligence to match you with a life insurance policy.

- Healthy individuals can qualify for no medical exam policies.

- You can receive up to in coverage.

View Rates

View Rates

on Sproutt’s website

Editorial Rating

Editorial Rating

What we like:

A unique Quality of Life Index that can lead to savings on your policy

Type of Life Insurance

Term life insurance is available online. Whole life, universal life, and guaranteed life insurance are available over the phone.

Coverage

–

Age Limits

–

Term Lengths

See how Sproutt compares to our top-rated life insurance companies

Compare Life Insurance

Sproutt, founded in 2018, is an online life insurance marketplace based in Hartford, Connecticut. The company does not write policies itself, but it uses data and artificial intelligence to assess customers’ needs in order to match them with well-established life insurers.

This review will discuss how Sproutt works, what is offered, pros and cons, and more. Read on to find out whether Sproutt can help you get the life insurance you need.

In this review:

Reputation & customer ratings

As a relatively young company, Sproutt is yet to receive many reviews from customers. However, the company does have a strong Trustpilot and BBB rating.

Trustpilot RatingBBB RatingSproutt4.8 out of 5A-

Accurate as of June 19, 2020.

In addition to these ratings, Sproutt is backed by Guardian Life Insurance, one of the largest life insurance companies. Guardian Life has an A+ BBB rating and an A++ (Superior) rating from A.M. Best Company.

With whom is Sproutt partnered?

As a marketplace, Sproutt has partnered with some of the top life insurers available to offer you the best rates. Before you apply, it could be helpful to know who these partners are. Here are some of the available carriers:

CarrierA.M Best RatingAIGA (Excellent)American NationalA (Excellent)Assurity Life InsuranceA- (Excellent)Banner LifeA+ (Superior)John HancockA+ (Superior)Lincoln FinancialA+ (Superior)Mass MutualA++ (Superior)Minnesota LifeA+ (Superior)NationwideA+ (Superior)Penn MutualA+ (Superior)PrincipalA+ (Superior)PrudentialA+ (Superior)And More

How

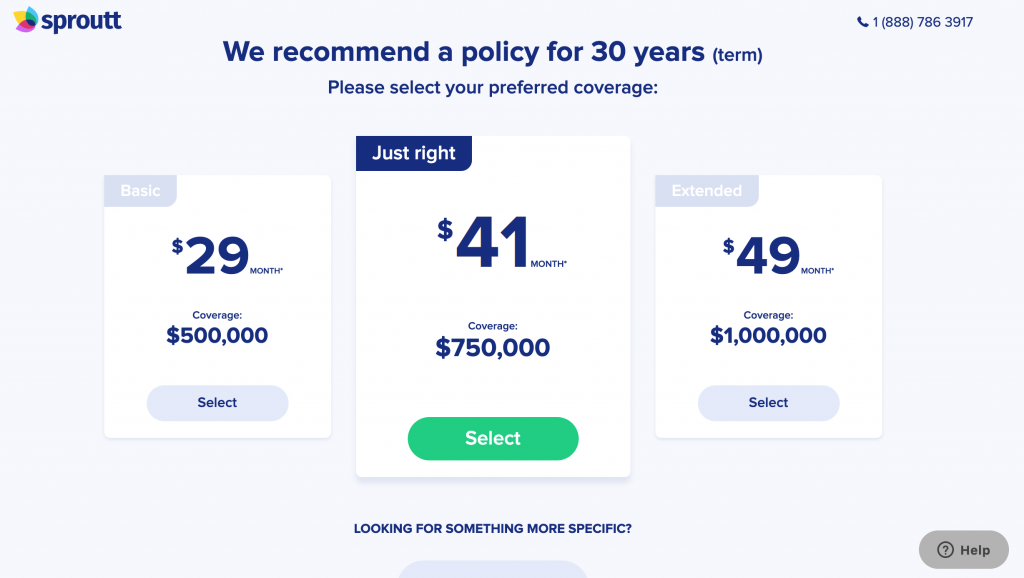

much does Sproutt cost?

The costs of life insurance coverage vary based on many factors, including the type of policy for which you’re looking, where you live, your age and health status, the amount of coverage you need, and the insurance provider you choose.

Here’s an example for a healthy 26-year-old male living in New Jersey who does not smoke:

How to apply (with screenshots)

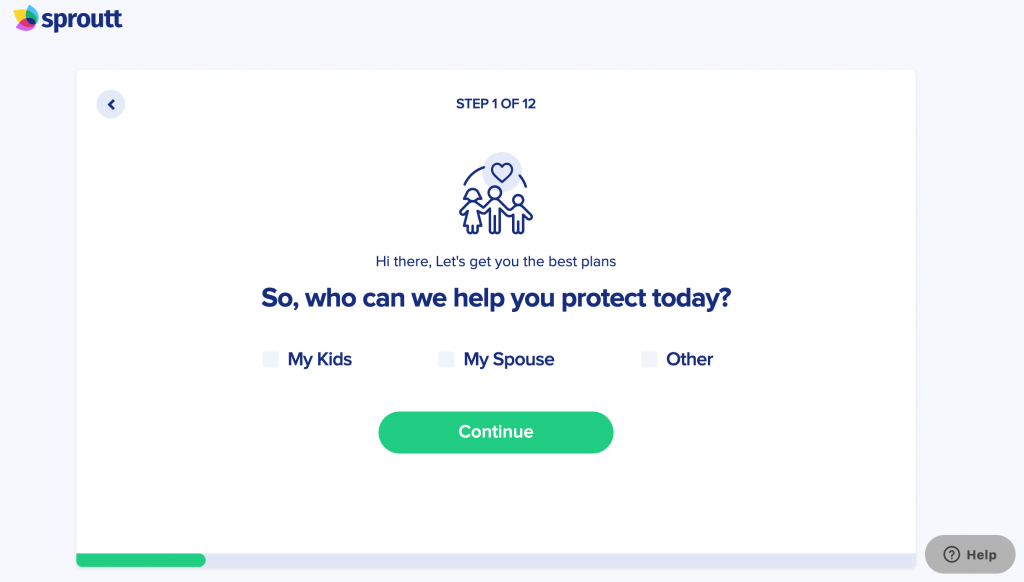

You can get a personalized quote online from Sproutt after answering 12 basic questions. We have included screenshots from our run-through of the application. Here are the questions you’ll be asked when filling out the application.

Note: The screenshots for steps two to 11 only include the question and answers but will look similar to the full page shown in the screenshot of step one.

Step 1: Who can we help you protect?

Step one asks who you’re planning to protect with your life insurance policy. The options include your kids, your spouse, or others. You can select multiple options.

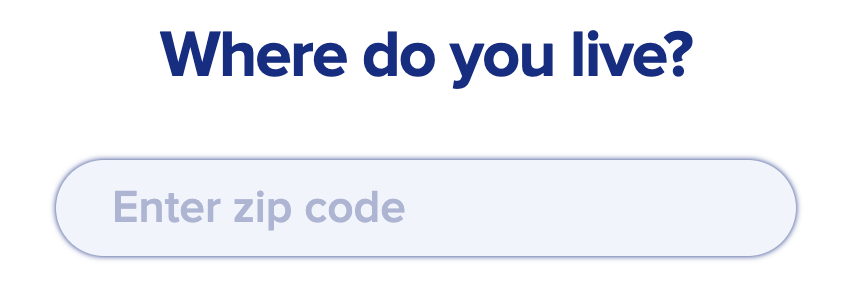

Step 2: Where do you live?

Step two asks where you live. This will help Sproutt determine which policies it should consider when trying to find you a match.

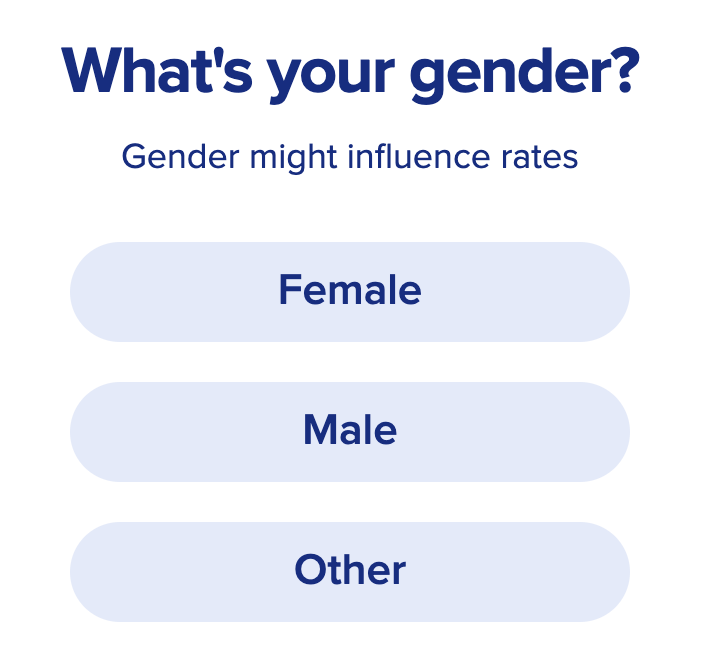

Step 3: What’s your gender?

Step three asks for your gender. As it states below the question, gender may influence the rates you receive.

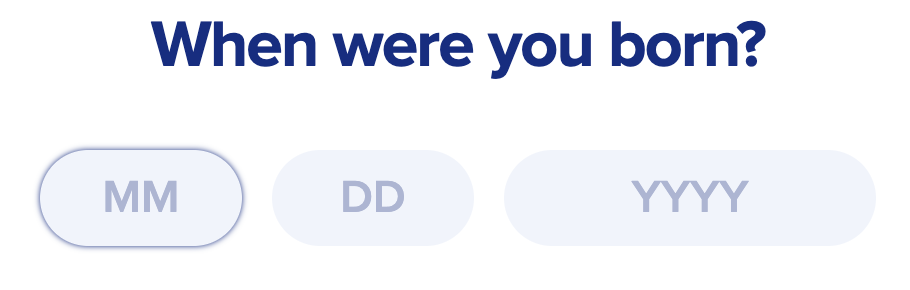

Step 4: When were you born?

Step four asks when you were born. This allows Sproutt to confirm you are between the required ages of and . In addition to determining eligibility, age can influence the rates you have to pay. Typically, the older you are, the higher your rates.

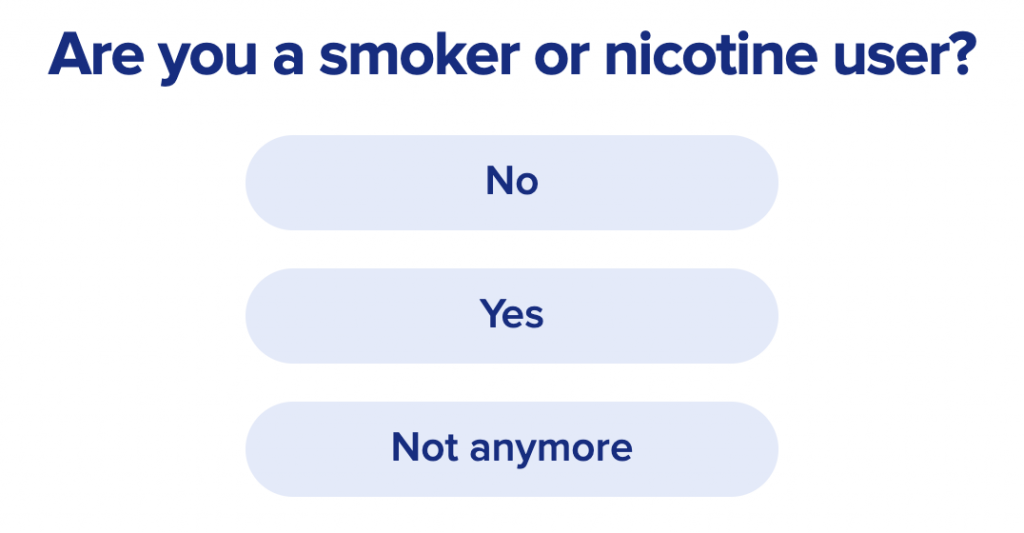

Step 5: Are you a smoker or nicotine user?

Step five asks if you are a smoker or nicotine user. This is a common question amongst life insurance policies. Being a smoker can lead to higher rates.

Step 6: How would you describe yourself?

Step six asks if you would consider yourself healthy or average. Being active and healthy is important to Sproutt and the company wants it to be important to you, too. If you are healthy and active, you may be able to receive lower rates.

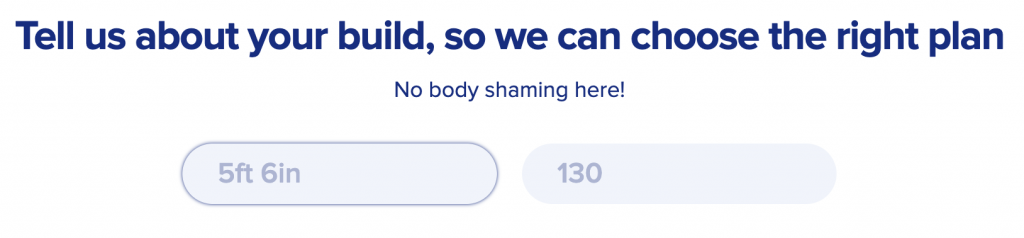

Step 7: What’s your height and weight?

Step seven asks for your height and weight. This information is used to help Sproutt determine your overall health.

Step 8: What’s your annual income?

Step eight asks for your annual income. Your annual income is used to ensure you can be matched with a policy that you can afford.

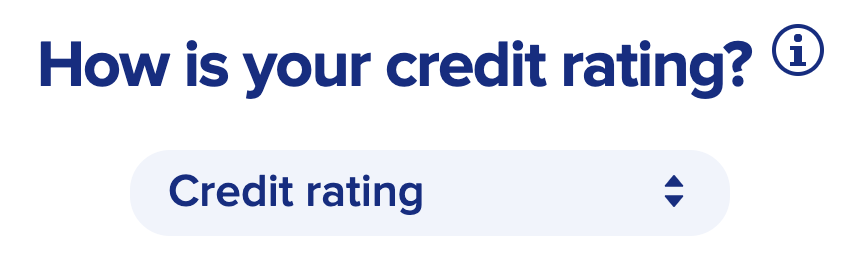

Step 9: How is your credit rating?

Step nine asks about your credit rating. Your credit rating can be used to determine your financial strength.

Step 10: What is more important to you?

Step 10 asks whether your monthly payment amount or insurance coverage amount is more important. Your answer here will help Sproutt pick a policy that you’re more likely to approve.

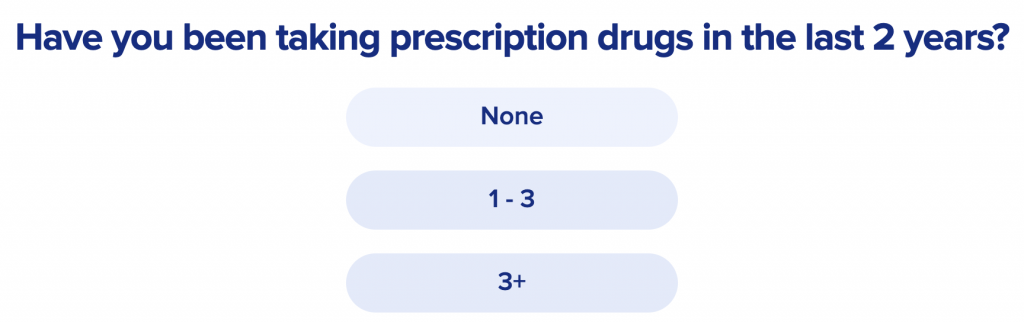

Step 11: Have you been taking prescription medication in the last two years?

Step 11 asks about prescription drugs you may have taken over the last two years. Prescription drugs are an important factor to life insurance providers because they can signal a current condition or have long-term side effects.

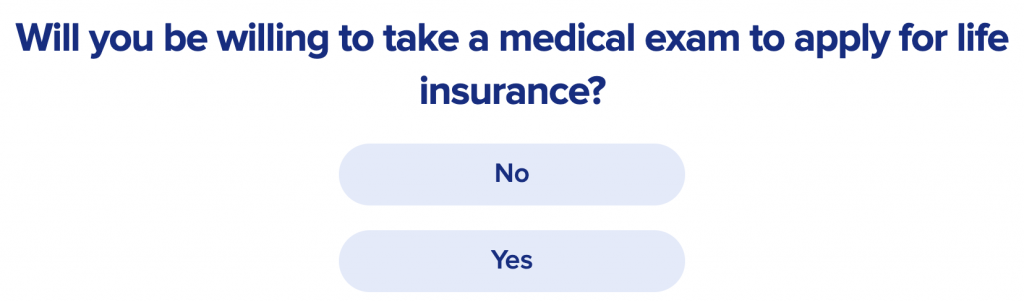

Step 12: Will you be willing to take a medical exam?

Step 12 asks whether you will be willing to take a medical exam when applying for life insurance. If you are a healthy individual, taking an exam can lead to lower rates. If you prefer to not take an exam, regardless of the reason, Sproutt will make sure to match you with a provider that doesn’t require it.

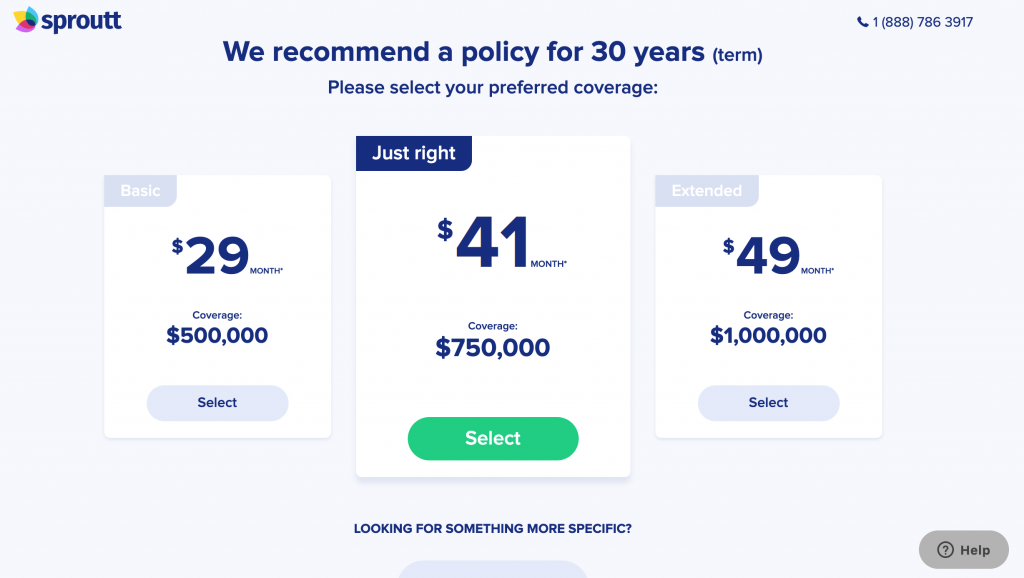

See your match or customize your policy

Once you complete the application, Sproutt will analyze your results and match you with the policy offering you the best rate. You have the option of choosing between one of three policies based Sproutt’s recommendation.

If you want to customize the policy further, you can click the “customize” button at the bottom of the page and make changes to the coverage and term.

Once you’ve been matched with an insurer, you’ll need to complete that insurer’s application process and fulfill its requirements to get covered.

Pros

& cons of Sproutt insurance

Pros

- Strong customer support: Advisers will walk you through the process of buying insurance coverage.

- Insurance coverage matched to your needs: You can answer a few simple questions and get feedback on what type of policy is right for you and what amount of coverage you need.

- Access to multiple insurers: Because Sproutt is an insurance broker, it helps you discover how much insurance would cost from multiple trusted life insurance providers.

- Available in all 50 states: You can apply through Sproutt from anywhere in the country.

Cons

- Sproutt doesn’t provide insurance directly, so you need to apply for and qualify for coverage from the insurer with which you’re matched.

- Sproutt is a relatively new company, and there aren’t a lot of customer reviews.

Sproutt

customer service

Sproutt provides

online support via chat or email. You can also contact Sproutt via phone to get

help exploring coverage options:

Where

to find Sproutt alternatives

Many life insurance providers and brokers help you get coverage that could protect your family. One alternative to Sproutt is Fiona, which is a life insurance search engine that shows you personalized quotes based on a form you fill out.

To compare other options, check out LendEDU’s top picks for the best life insurance companies or the best term life insurance providers.

Ready to fill out Sproutt’s life insurance application?

View Rates

View Rates

Coverage

–

Term Lengths

Age Limits

–

5.0

Sproutt Life Insurance